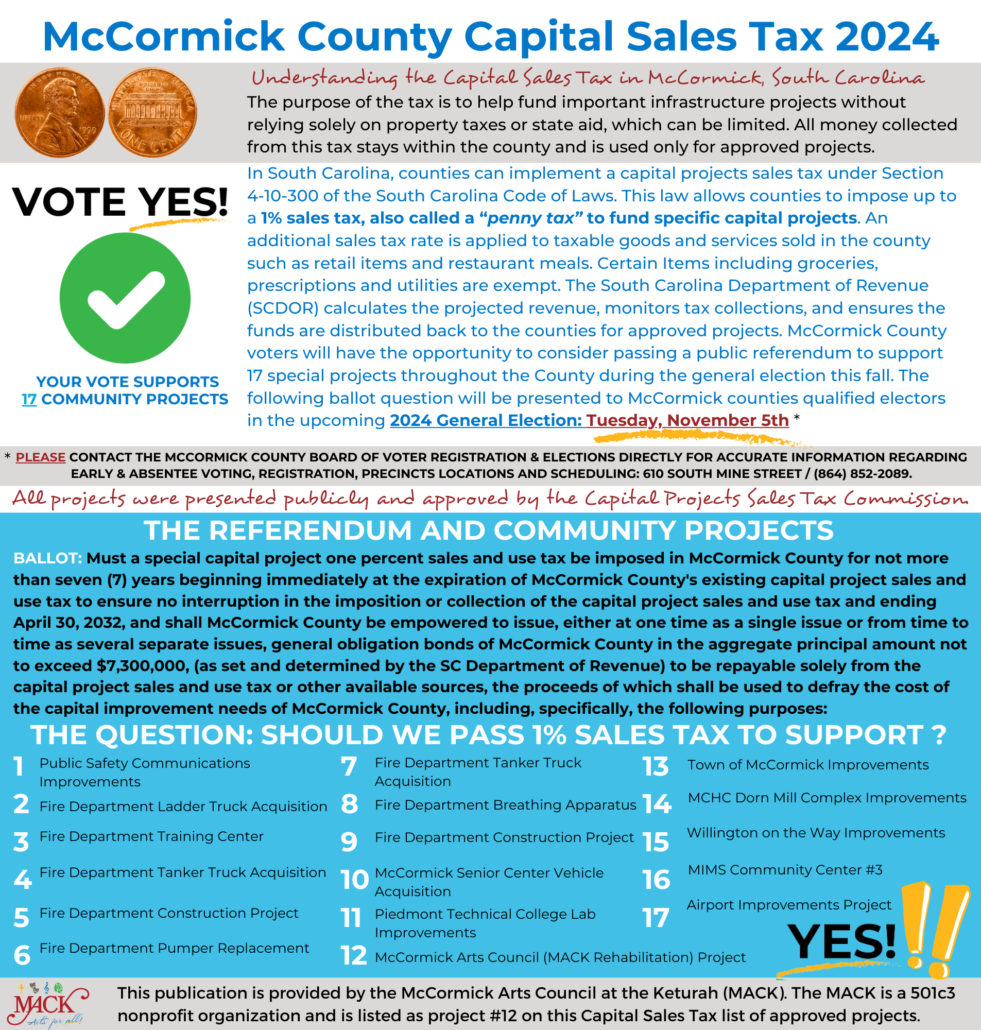

McCormick County Capital Sales Tax 2024: Capital Sales Tax to Fund Critical Infrastructure Projects

Printable / Sharable Version: CLICK HERE

McCormick County Capital Sales Tax 2024: Capital Sales Tax to Fund Critical Infrastructure Projects

[McCormick, South Carolina] – McCormick County is advancing a capital sales tax initiative designed to help fund essential infrastructure projects. All revenue generated from the tax will remain within the county and be dedicated exclusively to support approved local projects. The purpose of the tax is to help fund important infrastructure projects without relying solely on property taxes or state aid, which can be limited.

In South Carolina, counties can implement a capital projects sales tax under Section 4-10-300 of the South Carolina Code of Laws. This law allows counties to impose up to a 1% sales tax, also called a “penny tax” to fund specific capital projects. An additional sales tax rate is applied to taxable goods and services sold in the county such as retail items and restaurant meals. Certain Items including groceries, prescriptions and utilities are exempt.

The South Carolina Department of Revenue (SCDOR) calculates the projected revenue, monitors tax collections, and ensures the funds are distributed back to the counties for approved projects. McCormick County voters will have the opportunity to consider passing a public referendum to support 17 special projects throughout the County during the general election this fall. The following ballot question will be presented to McCormick counties qualified electors in the upcoming 2024 General Election: Tuesday, November 5th. *

The following question will appear on the 2024 ballot:

“Must a special capital project one percent sales and use tax be imposed in McCormick County for not more than seven years beginning immediately at the expiration of McCormick County’s existing capital project sales and use tax to ensure no interruption in the imposition or collection of the capital project sales and use tax and ending April 30, 2032, and shall McCormick County be empowered to issue, either at one time as a single issue or from time to time as several separate issues, general obligation bonds of McCormick County in the aggregate principal amount not to exceed $7,300,000, to be repayable solely from the project sales and use tax or other available sources, the proceeds of which shall be used to defray the cost of the capital improvement needs of McCormick County, including, specifically, the following purposes:”

- Public Safety Communications Improvements, McCormick County

- Fire Department Ladder Truck Acquisition, McCormick County

- Fire Department Training Center, McCormick County

- Fire Department Tanker Truck Acquisition, Town of Parksville

- Fire Department Construction Project, Clarks Hill/Lost Wilderness

- Fire Department Pumper Replacement, Clarks Hill/Lost Wilderness

- Fire Department Tanker Truck Acquisition, Town of McCormick

- Fire Department Breathing Apparatus, Clarks Hill/Lost Wilderness

- Fire Department Construction Project, McCormick County/ Modoc

- McCormick Senior Center Vehicle Acquisition

- Piedmont Technical College Lab Improvements

- McCormick Arts Council (MACK Rehabilitation) Project

- Town of McCormick Improvements

- MCHC Dorn Mill Complex Improvements

- Willington on the Way Improvements

- MIMS Community Center #3

- Airport Improvements Project

IMPORTANT INFO: All projects were presented publicly and approved by the Capital Projects Sales Tax Commission. The value of the Capital Sales Tax is set and is overseen by the South Carolina Department of Revenue.

THE QUESTION: SHOULD WE PASS 1% SALES TAX TO SUPPORT?

THE ADVOCACY ANSWER: YES! (PLEASE and THANK YOU!)

* Please contact the McCormick County Board of Voter Registration & Elections directly for accurate information regarding Early & Absentee Voting, registration, precincts locations and scheduling: 610 South Mine Street / (864) 852-2089.

For additional information or to request materials, please contact us at McCormickArts@gmail.com.

This article and related materials are provided by the McCormick Arts Council at the Keturah (MACK). The MACK is a 501c3 nonprofit organization and is listed as project #12 on this Capital Sales Tax list of approved projects.